dallas texas local sales tax rate

The Texas sales tax of 625 applies countywide. The County sales tax rate is.

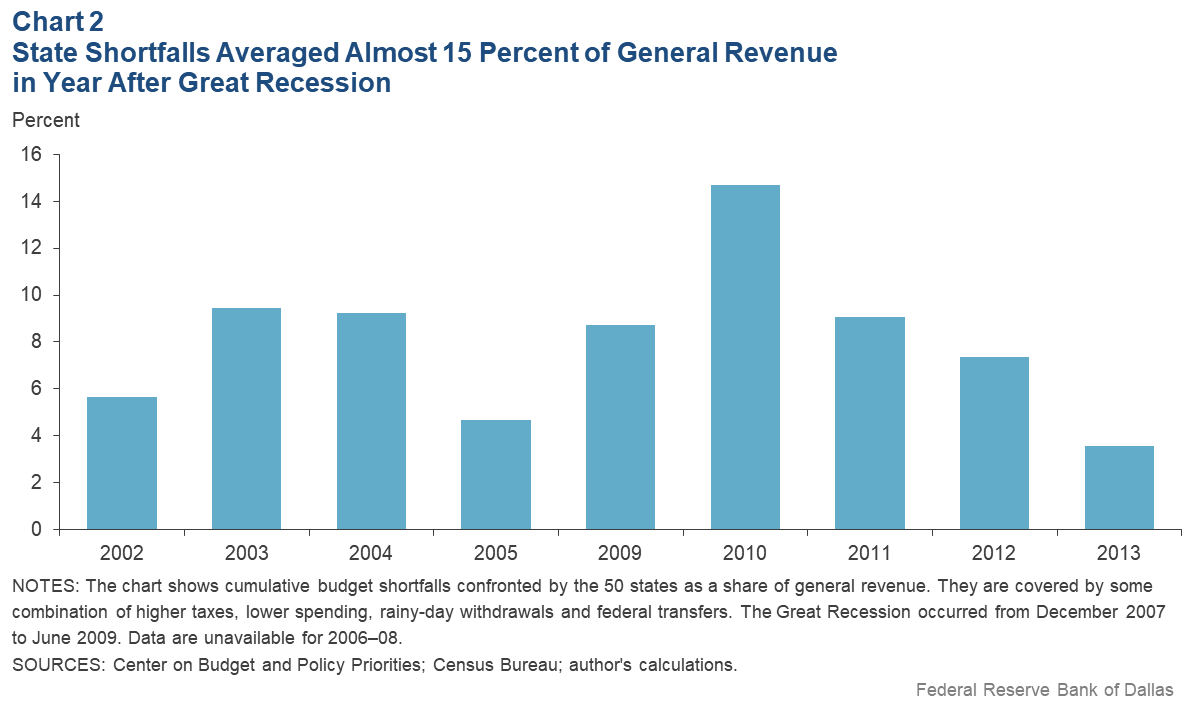

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Some cities and local governments in Dallas County collect additional local sales taxes which can be as high as 2.

.png)

. 104 rows 2021 Tax Rates Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. You can print a 825 sales tax table here.

The Dallas sales tax rate is 825 What is the local sales tax rate in Texas. Texas sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The Dallas sales tax rate is.

Texas has recent rate changes Thu Jul 01 2021. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. This is the total of state county and city sales tax rates.

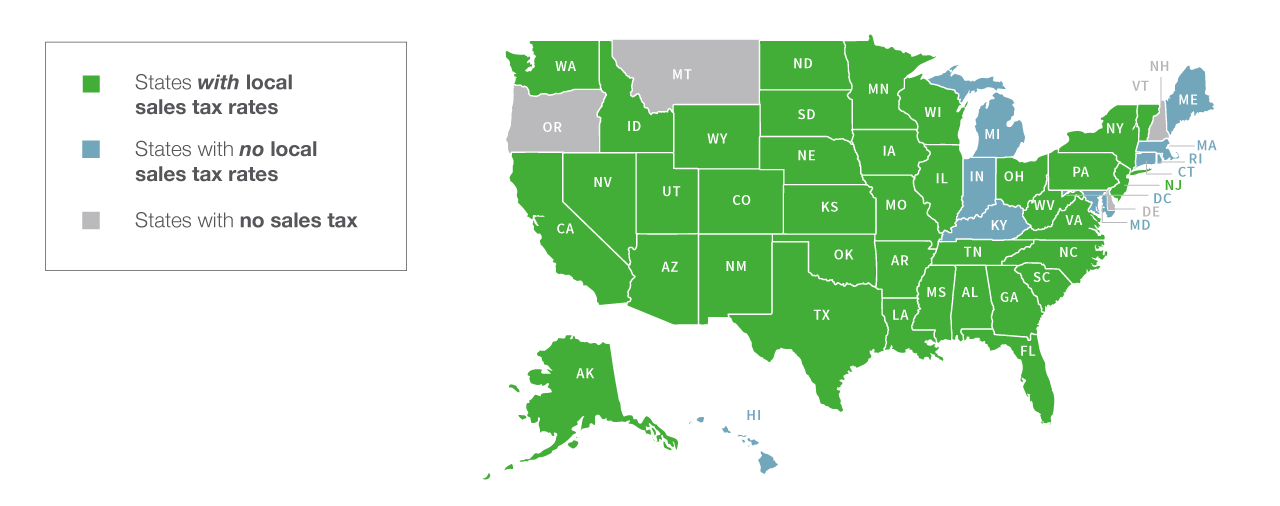

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. The state sales tax rate in Texas TX is currently 625. The rates shown are for each jurisdiction and do not represent the total rate in the area.

Fill in price either with or without sales tax. Records Building 500 Elm Street Suite 3300 Dallas TX 75202. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

Find your Texas combined state and local tax rate. Dallas collects the maximum legal local sales tax The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. 214 653-7811 Fax.

The Texas sales tax rate is currently. Dallas in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Dallas totaling 2. If an exact rate is not returned click on HELP above right corner for more information.

The Lake Dallas sales tax rate is. The 2018 United States Supreme Court decision in South Dakota v. Dallas County Texas Sales Tax Rate 2022 Up to 825 Dallas County Has No County-Level Sales Tax While many counties do levy a countywide sales tax Dallas County does not.

Depending on local municipalities the total tax rate can be as high as 825. Get rates tables What is the sales tax rate in Dallas Texas. The minimum combined 2022 sales tax rate for Dallas Texas is.

Local Code Local Rate Total Rate. Did South Dakota v. Counties cities and districts impose their own local taxes.

You can find more tax rates and allowances for Dallas and Texas in the 2022 Texas Tax Tables. Texas TX Sales Tax Rates by City The state sales tax rate in Texas is 6250. To make matters worse rates in most major cities reach this limit.

The base state sales tax rate in Texas is 625. There is no applicable county tax. Did South Dakota v.

What is the tax on 20 in Texas. There are a total of 981 local tax jurisdictions across the state collecting an average local tax of 1681. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825.

With local taxes the total sales tax rate is between 6250 and 8250. Wayfair Inc affect Texas. 104 rows 2021 Tax Rates.

US Sales Tax Texas Dallas Sales Tax calculator Dallas. There is base sales tax by Texas. The top 12 city sales and.

Calculator for Sales Tax in the Dallas. For tax rates in other cities see Texas sales taxes by city and county. City sales and use tax codes and rates.

Texas Comptroller of Public Accounts. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas sales tax rate totals 825. Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825.

214 653-7888 Se Habla Español ENTITY NAME. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. You may submit a file with multiple addresses using our Secure.

Sales and use tax rates in the Houston region vary by city. Wayfair Inc affect Texas. Enter the Address City and Zip Code in the above fields to obtain the tax jurisdiction s and tax rate s for the address entered.

Texas Sales Tax. 214 653-7811 Fax. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community. Avalara provides supported pre-built integration. The results are rounded to two decimals.

The County sales tax rate is. Download and further analyze current and historic data using the Texas Open Data Center. Dallas MTA Transit stands for Metropolitan Transit Authority of Dallas.

Maintenance Operations MO and Interest Sinking Fund IS Tax Rates. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose a sales and use tax up to 2 percent for a total maximum combined rate of 825 percent. The Texas sales tax rate is currently.

Select the Texas city from the list. Adkins Bexar Co 082500. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied.

Has impacted many state nexus laws and sales tax collection requirements.

Texas Sales Tax Guide For Businesses

Texas County Challenge Texas County Map Texas County Texas Map

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

How To Charge Your Customers The Correct Sales Tax Rates

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Texas Sales Tax Guide For Businesses

How To File And Pay Sales Tax In Texas Taxvalet

How To File And Pay Sales Tax In Texas Taxvalet

Texas Sales Tax Rates By City County 2022

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

.png)

States Sales Taxes On Software Tax Foundation

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Guide And Calculator 2022 Taxjar

Which Texas Mega City Has Adopted The Highest Property Tax Rate

How To Charge Your Customers The Correct Sales Tax Rates

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To File And Pay Sales Tax In Texas Taxvalet